In Osun State, paying your taxes is now easier than ever, thanks to the POS Marshal method. This convenient option allows residents to handle tax payments without the need for lengthy bank visits or long queues. POS Marshals are authorized personnel equipped with mobile Point-of-Sale devices, strategically stationed across the state to assist with tax payments on the go. Whether you’re in a busy market area or a local neighbourhood, the POS Marshal method offers a quick, secure, and accessible way to fulfill your tax obligations. In this guide, we’ll show you how to use this method step-by-step, so you can stay compliant and support state development effortlessly.

How to Pay Your Taxes via POS Marshal Method in Osun State

For those looking to pay their taxes with ease and convenience in Osun State, the POS Marshal method offers a hassle-free, accessible option. POS Marshals are equipped with Point-of-Sale (POS) devices to facilitate tax payments without the need for a trip to the bank or a tax station. This method is ideal for busy taxpayers who prefer quick transactions and easy access to payment facilities within their local area. Here’s a simple guide on how to pay your taxes using the POS Marshal method in Osun State.

Step 1: Locate a POS Marshal

The first step is to find an authorized POS Marshal near you. Osun State has deployed POS Marshals in various locations ( Ministries, Local Governments, etc) to make tax payments more accessible to residents. You can check with the Osun State Internal Revenue Service (OIRS) or visit their website for information on the closest POS Marshal points.

Step 2: Bring the Required Information and Documents

Before approaching the POS Marshal, make sure you have the necessary details and documents:

- Your ATM Card

- Tax Payer ID (PID) or Instant Payment Number (IPN) – This is crucial to link your payment to your tax records.

- Tax Payment Amount – If you have a tax notice or invoice, bring it along to ensure the payment details are accurate. This includes the Agency and revenue Codes for the tax you intend to pay

- Valid ID – Having an identification document may help the POS Marshal verify your information if needed.

Step 3: Request Tax Payment Service from the POS Marshal

Once you locate the POS Marshal, inform them that you would like to make a tax payment. Provide them with your PID or IPN, along with any supporting documents like the Agency and Revenue code for the payment you wish to make. The POS Marshal will input this information to verify your tax records and confirm the amount you need to pay.

Step 4: Complete the Payment

The POS Marshal will process your payment through their POS device, allowing you to pay using a debit card. This method is especially convenient because it allows you to avoid cash transactions and provides instant payment confirmation.

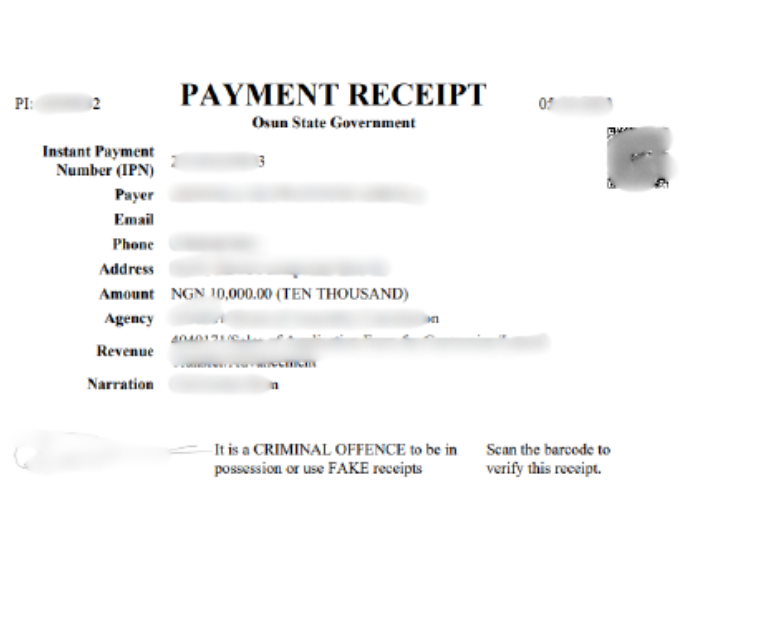

Step 5: Collect Your Receipt

After the payment is completed, the POS Marshal will issue you a POS receipt as proof of payment. Collect the Automated Revenue Receipt from the marshal after you have collected the POS receipt. Keep these receipts for your records, as they serve as evidence that you have fulfilled your tax obligations.

Step 6: Verify Your Payment

As it is important to confirm that your payment was successfully processed, you can scan the Bar code on the Automated Revenue Receipt and you can also visit the Osun State Tax Clearance Validation portal here to validate your tax clearance. Also, you can visit https://pay.irs.os.gov.ng and check your payment status using your PID or IPN.

Benefits of the POS Marshal Method

- Quick and Convenient: POS Marshals are often located in accessible areas, saving you time.

- Secure Payment: Pay directly with a debit card, avoiding the need for cash transactions.

- Instant Confirmation: Receive an official receipt on the spot, ensuring that your payment is properly documented.

Tips for a Smooth POS Marshal Payment Experience

- Ensure Sufficient Funds: Make sure your card has enough funds for the payment to avoid any delays.

- Double-Check Details: Confirm that the POS Marshal inputs the correct Details (Revenue/Agency Code, PID or IPN) to avoid errors.

- Keep Your Receipt Safe: Store your receipt as a reference for your tax records.

By using the POS Marshal method, paying your taxes in Osun State becomes a fast and straightforward process, with accessible locations and easy payment options. Take advantage of this convenient service to fulfill your tax responsibilities without the hassle.