Paying taxes is an essential civic duty that helps support public services, infrastructure, and overall development in Osun State. For residents and businesses looking to fulfill their tax obligations conveniently, Osun State offers multiple payment methods, including an option to pay directly through designated banks. This bank payment method is especially beneficial for those who prefer a traditional, in-person approach or who may not be comfortable with online transactions. In this guide, we’ll walk you through the step-by-step process of paying your taxes via bank payment in Osun State, ensuring a smooth, secure, and efficient experience.

How to Pay Your Taxes via Bank Payment Method in Osun State

If you prefer paying taxes through a bank, Osun State offers a convenient option for tax payments at designated bank branches. Here’s a step-by-step guide to paying your taxes in Osun State through the bank payment method.

Step 1: Obtain Your Tax Invoice or Payment Reference

Before heading to the bank, ensure you have all the necessary payment information:

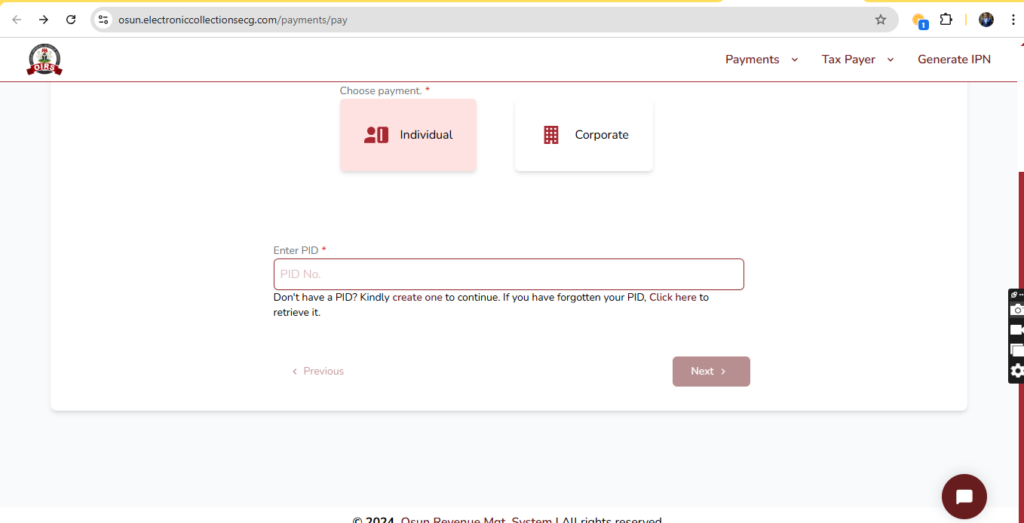

- Visit the Osun State Revenue portal at https://pay.irs.os.gov.ng.

- Select the type of payer (Individual or Company) and Log in with your PID or generate one here if it’s your first time.

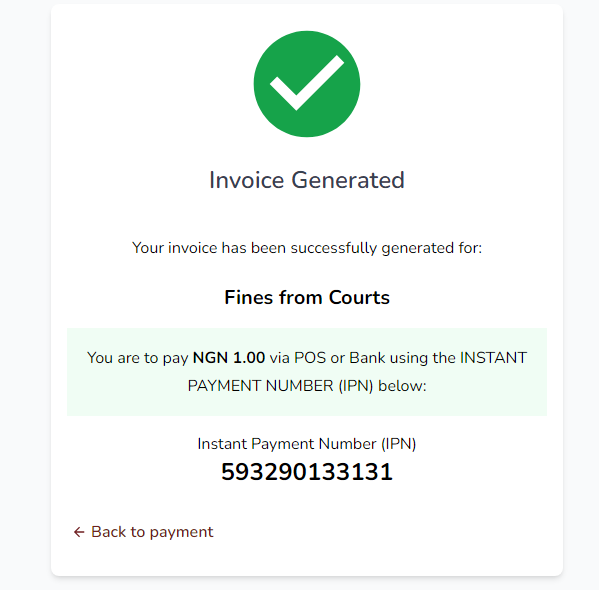

- Generate your tax invoice or payment reference (IPN) based on the type of tax you want to pay. This could include personal income tax, corporate tax, or harmonized bills.

Your Instant Payment Number (IPN) or Taxpayer ID Number ( PID) is essential to ensure the payment is credited accurately.

Step 2: Choose a Designated Bank

Osun State has partnered with all commercial banks to facilitate tax payments. You can make your payment at any of the commercial banks across the state and the country generally.

Step 3: Complete the Bank Payment

When at the bank:

- Inform the bank teller that you want to pay your Osun State taxes.

- Provide the teller with your Instant Payment Number (IPN) or Taxpayer ID, along with the tax amount specified on your invoice.

- Verify that the tax payment details on the payment slip are correct before making the payment. Also make sure the account being paid to carries Osun State Government name.

Step 4: Collect and Keep Your Payment Receipt

Once the payment is complete, collect a receipt in form of Automated Revenue Receipt (ARR) from the bank as proof of payment. This receipt is crucial for record-keeping and may be needed if there’s a need to confirm your payment with the Osun State Revenue Office.

Step 5: Confirm Your Payment on the Osun State Revenue Portal

After making the payment, visit the Osun State Revenue portal to confirm that your payment has been successfully processed:

- Log in to your account on https://pay.irs.os.gov.ng to verify if the payment has been reflected.

- If there’s any delay or discrepancy, contact the Osun State Revenue Office with your bank receipt for assistance.

Why Pay Taxes Through the Bank?

- Convenient for Offline Users: Ideal for those who prefer not to make online payments.

- Reliable Record: Bank receipts serve as a formal record of your payment.

- Flexible Options: You can pay through bank tellers, ATM transfers, or mobile banking.

Tips for a Smooth Bank Payment Experience

- Double-Check Details: Ensure all invoice numbers and payment details are accurate to avoid delays.

- Use Designated Banks: Confirm that the bank is authorized to accept Osun State tax payments.

- Keep Records Safe: Always keep your bank receipt or transfer confirmation in case of future verification needs.

By following these steps, you can pay your taxes in Osun State efficiently through the bank. Stay compliant, and contribute to the development of Osun State with ease!