Paying your harmonized bills in Osun State has become straightforward, thanks to the state’s online payment platforms. This step-by-step guide will walk you through the process so you can handle payments yourself without hassle.

If you’re looking for a quick and straightforward way to pay your harmonized bill in Osun State, the invoice payment option on the Osun State Revenue portal (https://pay.irs.os.gov.ng/) is the ideal choice.

Here’s a step-by-step guide on completing your payment smoothly using your Instant Payment Number (IPN).

Step-by-Step Guide to Paying Your Harmonized Bills

Visit the Osun Revenue Portal

Go to https://pay.irs.os.gov.ng to access the official Osun State Revenue payment portal.

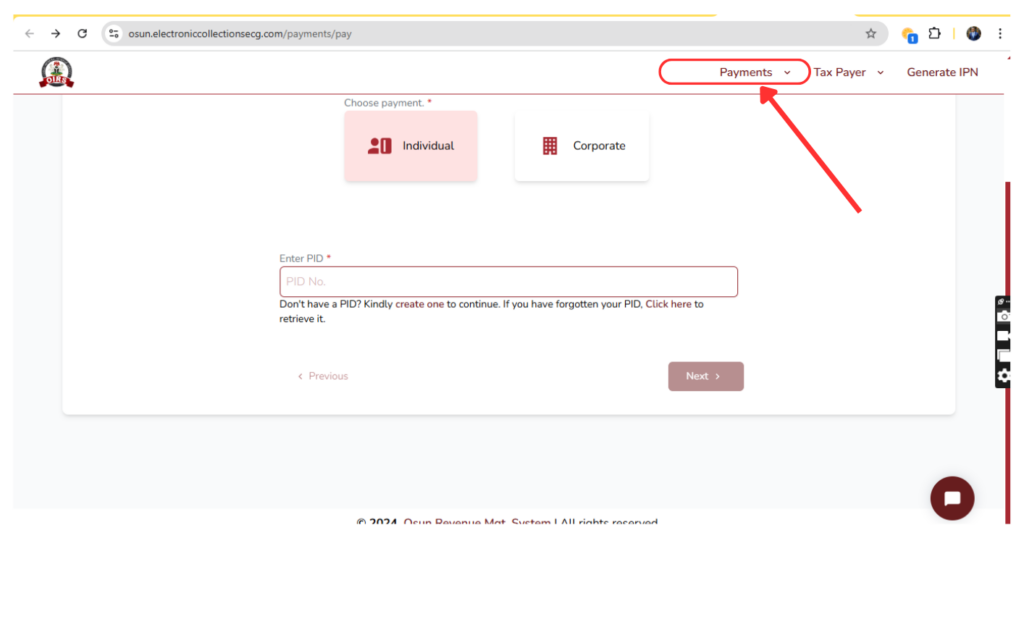

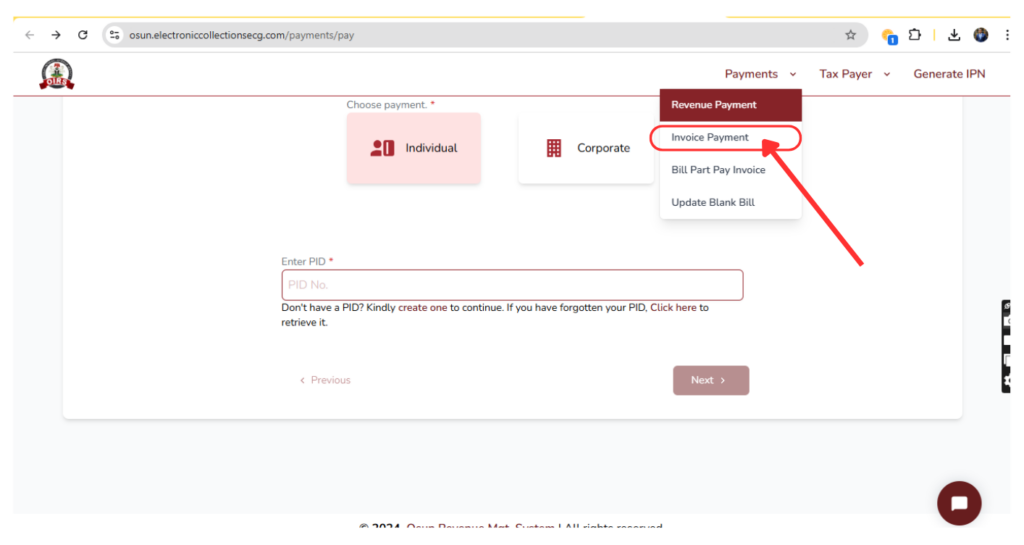

Choose the Invoice Payment Option

On the homepage, Click on the Payments Option and then select Invoice Payment from the dropdown menu as shown in the image below.

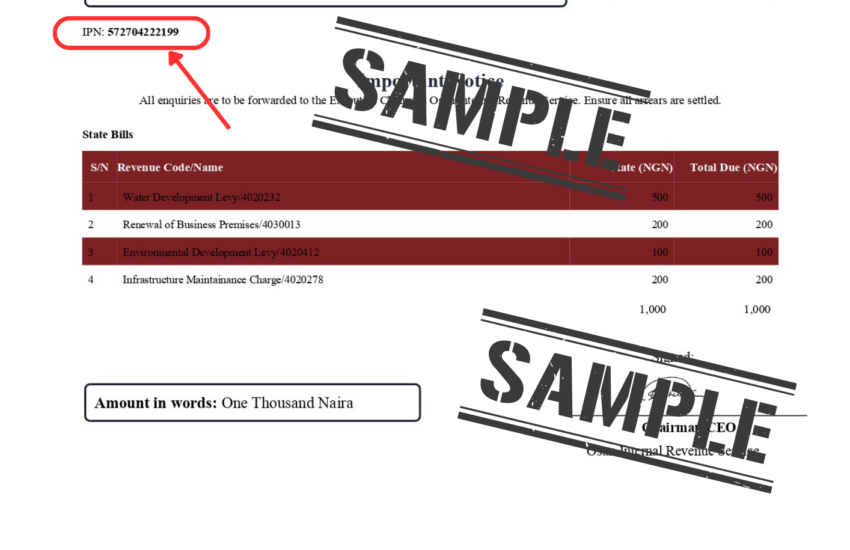

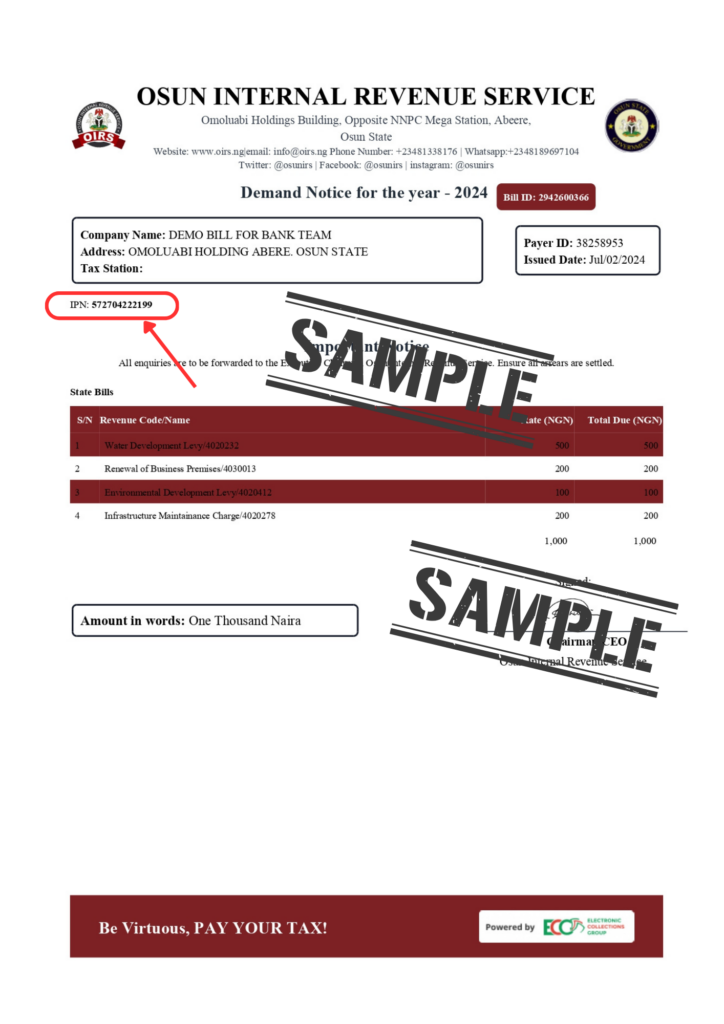

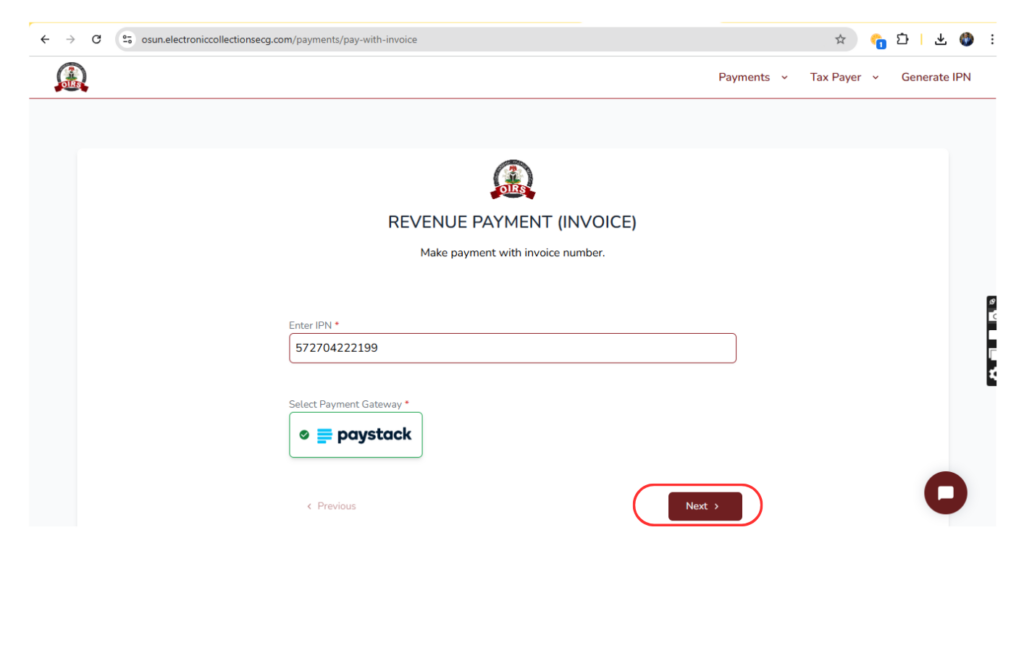

This will lead you to the invoice payment section. Enter Your IPN. Locate the Instant Payment Number (IPN) on your Harmonized Bill letter. This is a unique identifier for your bill. Enter the IPN in the field labelled “Enter IPN” on the payment page. Your IPN is located on your Harmonized Bill as shown below

Proceed with Payment

After entering the IPN, the payment gateway is displayed

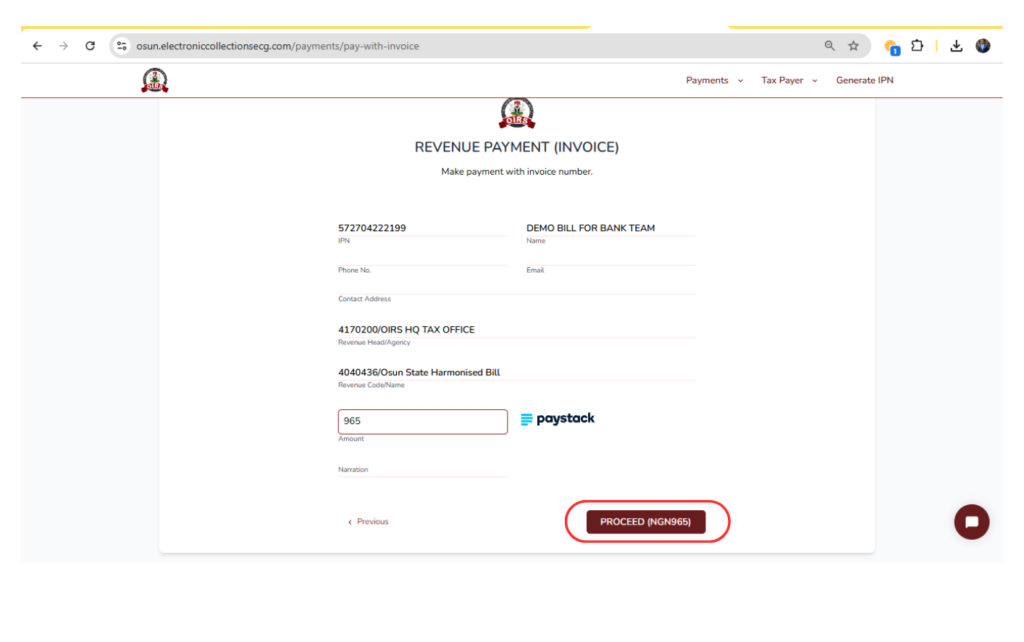

click Next. This will display your invoice details, including the amount to be paid. Review the information carefully to ensure accuracy. Then click the Proceed button

Select Payment Method

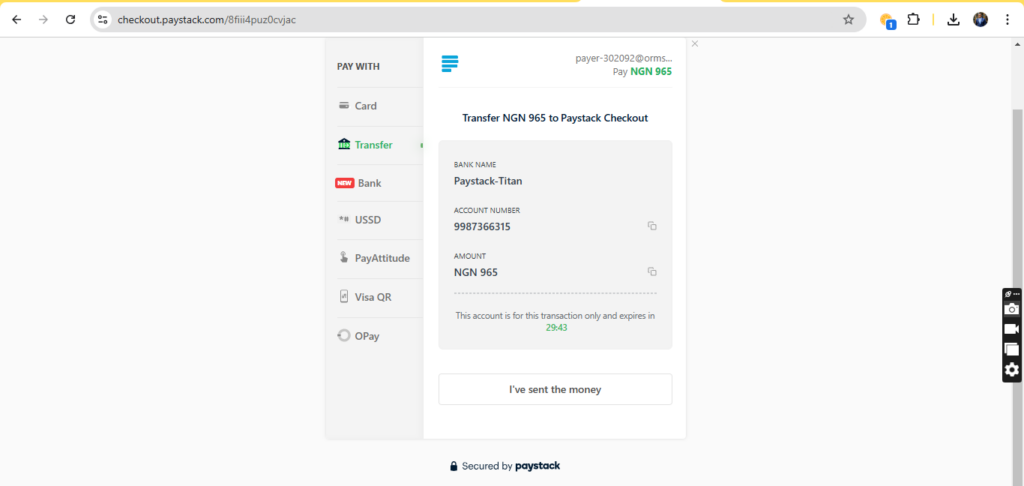

Choose your preferred payment method, such as debit card, bank transfer, or mobile wallet, and follow the on-screen prompts to complete the transaction.

Save Your Payment Receipt

Once your payment is successful, a digital receipt will be generated. Print or save it as proof of payment, in case it’s needed for future reference.

Upon Payment, ensure you obtain an Automated Revenue receipt for your payment and in case of a Complete payment, you will get a Harmonized Bill Payment Clearance Certificate.

Why Use the Invoice Payment Option?

- Convenient Access: You can pay from anywhere, at any time.

- Quick Payment Process: Entering the IPN streamlines the process, allowing you to complete payments in minutes.

- Secure Transactions: All transactions on the portal are secure, keeping your information safe.

By following these steps, paying your harmonized bill in Osun State becomes easy and efficient. Use the invoice payment option for a smooth experience and stay compliant with your tax obligations.

Official Payment Channels in the State

You can pay your harmonized bill or any other revenue due to Osun State Government via these Official Channels:

Online: Go to http://pay.irs.os.gov.ng (Get your Payer ID ready, if you have forgotten your payer ID you can retrieve it from ecg.ng/retriveosunpid).

POS in Tax Stations: You can visit any of our Tax stations and Pay with your card or Transfer to a Government Account. Kindly ensure that any Bank Account you are transferring to carries the Osun State Government name.

Bank in Osun: Visit any Bank in Osun state to Pay and Get Your Government receipt after payment.

Banks Outside Osun: Visit any Bank outside Osun state and Pay Via PAYDIRECT (but first generate IPN via ecg.ng/generateosunipn and after payment, generate your receipt from ecg.ng/genosunpayreceipt).

ATM Machine across the country: Via Quickteller Menu on the ATM (but first generate IPN via ecg.ng/generateosunipn and after payment, generate your receipt from ecg.ng/genosunpayreceipt);

From Outside the Country: Using any Money Transfer Service, Transfer using the Pay with Transfer feature online on http://pay.irs.os.gov.ng (Get your Payer ID ready, if you have forgotten your payer id you can retrieve it from ecg.ng/retriveosunpid or generate a new one if this is your first time paying)

Important Notice

Ensure you collect your evidence of payment in form of an Automated Revenue Receipt (A.R.R) in respect of all payments. Where you have an objection against any arrears raised, kindly contact us with the proof of payment.

Do not Pay cash to any staff or official or pay/transfer to any non-government bank account.

Dedicated Reporting Channels

Should you suspect any foul play or if anyone brings any other Demand Notice to your premises for annual levies/taxes, Please report such person to the Authority for strong action against such person(s) via +2349165066144 and email via reportculprit@oirs.ng or Call 09159940098, 09118132994, WhatsApp: 09077369909.