In an era dominated by digital advancements, the traditional processes of tax payment have undergone a remarkable transformation. Osun State, known for its commitment to innovation and efficiency, has embraced the digital frontier to streamline its tax collection system.

As we navigate the complexities of the modern world, understanding how to pay taxes online has become an essential skill for individuals and businesses alike.

This blog post aims to serve as your comprehensive guide to online tax payment in Osun State, empowering you with the knowledge and tools needed to fulfil your tax obligations seamlessly. Whether you’re a seasoned taxpayer or a newcomer to the world of online transactions, join us on this informative journey as we explore the step-by-step process, demystify the digital platforms, and highlight the benefits of embracing this convenient method in Osun State. Let’s unlock the potential of technology to simplify your tax responsibilities and contribute to the growth and development of our vibrant community.

Below are the steps to follow:

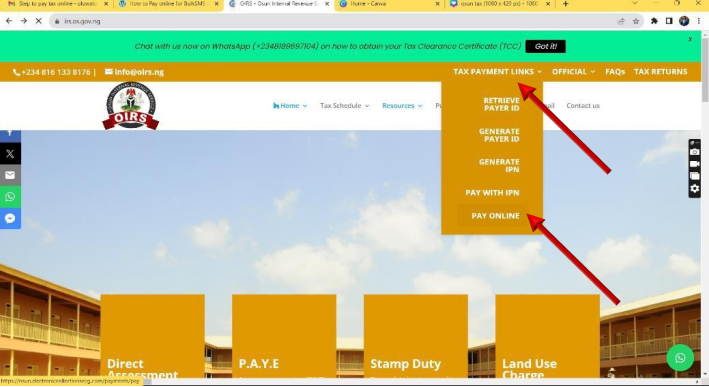

- Visit www.irs.os.gov.ng and select pay online by clicking on tax payment link (or on the 3 dashes (menu icon) if using a mobile device).

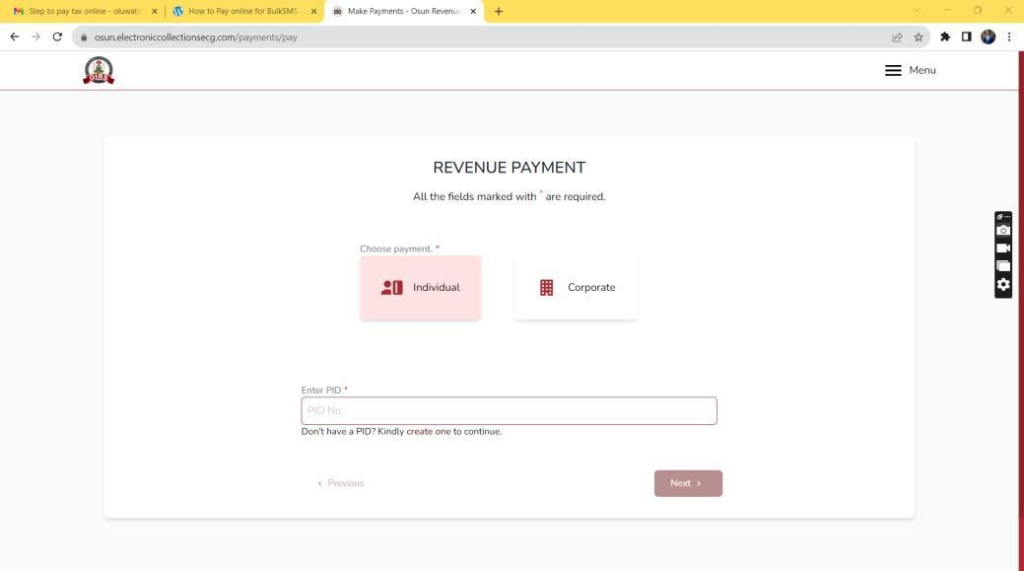

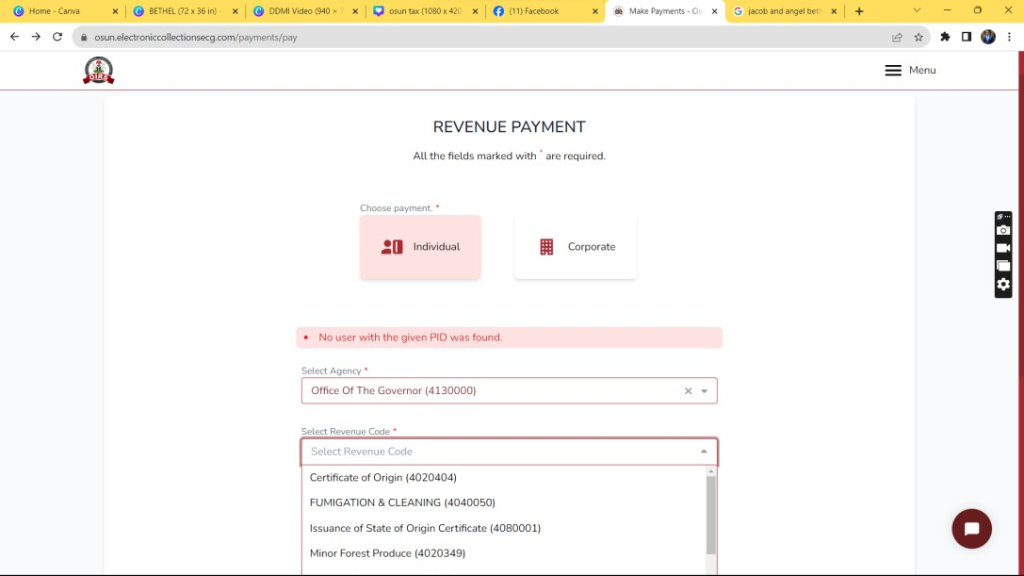

- Select the category of tax payer (Individual or Corporate)

- If you are a new tax payer, you will have to register to get a Payer ID (PID) for subsequent payments. Ensure all the information provided is correct and accurate. You can click here to register your PID.

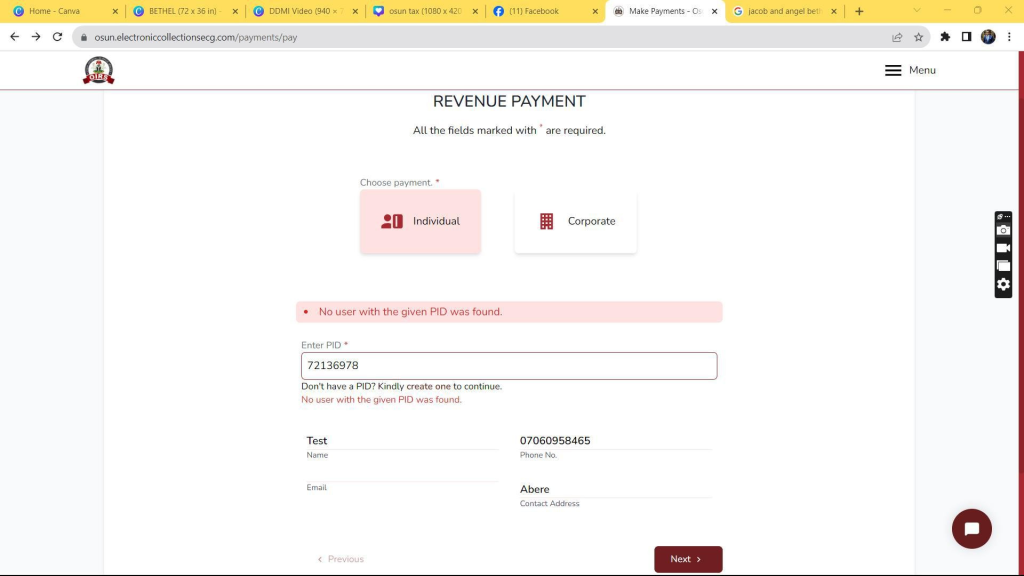

- Enter your PID, wait for the verified payer details to be displayed, then click next

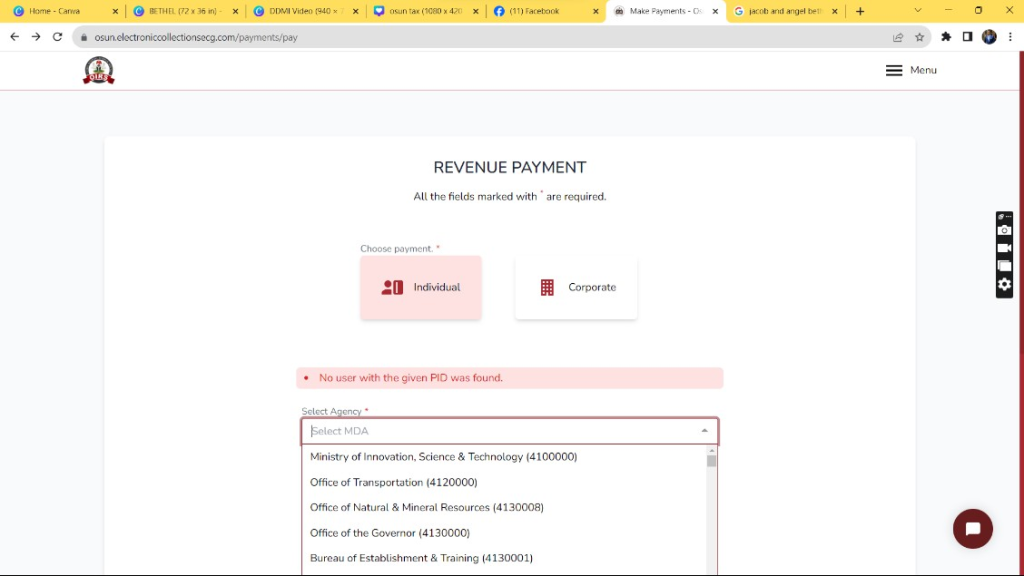

- Kindly select the appropriate agency in Osun to whom payment is to be made, or type in the agency’s code:

Select the revenue to be paid or type in the revenue code:

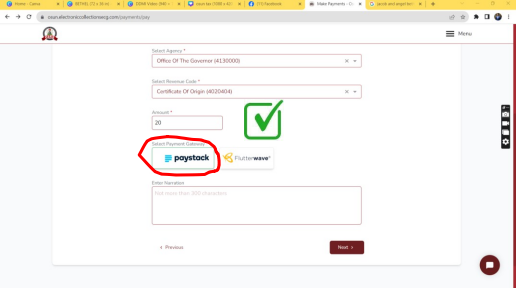

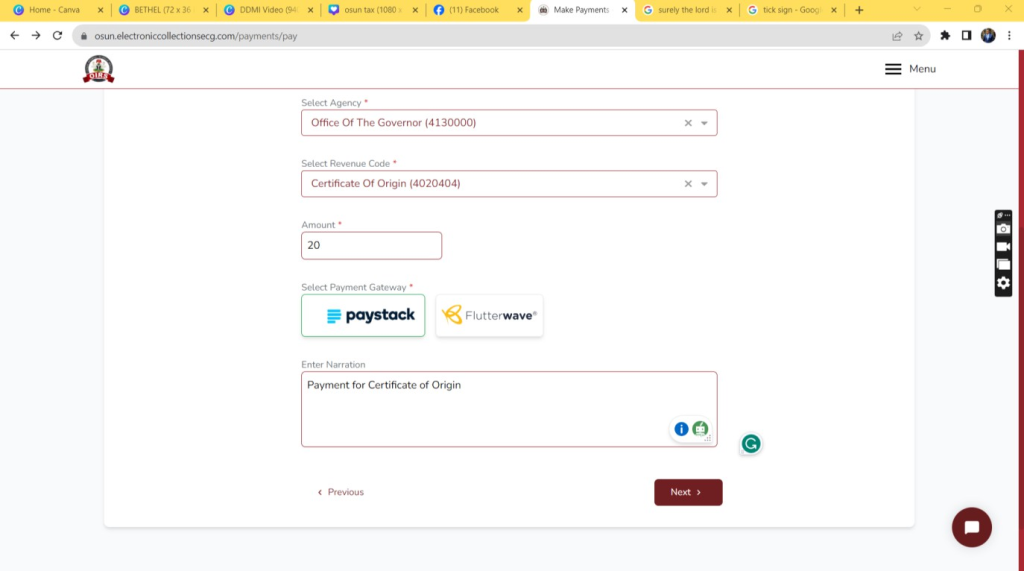

Enter the amount of payment and select your payment gateway

Enter the narration of payment and click Next

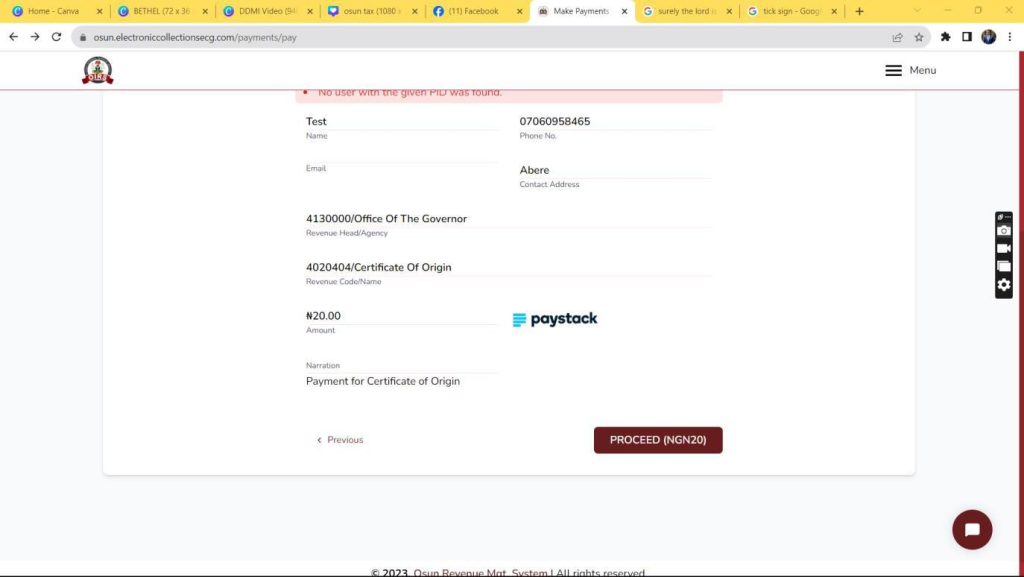

Preview the information and Proceed

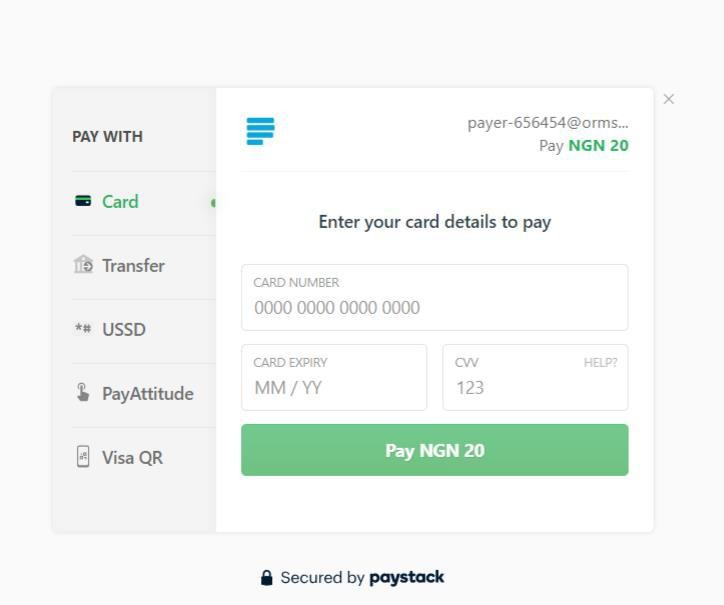

Make payment on any multiple channels available. (Card, Transfer, USSD, etc.)

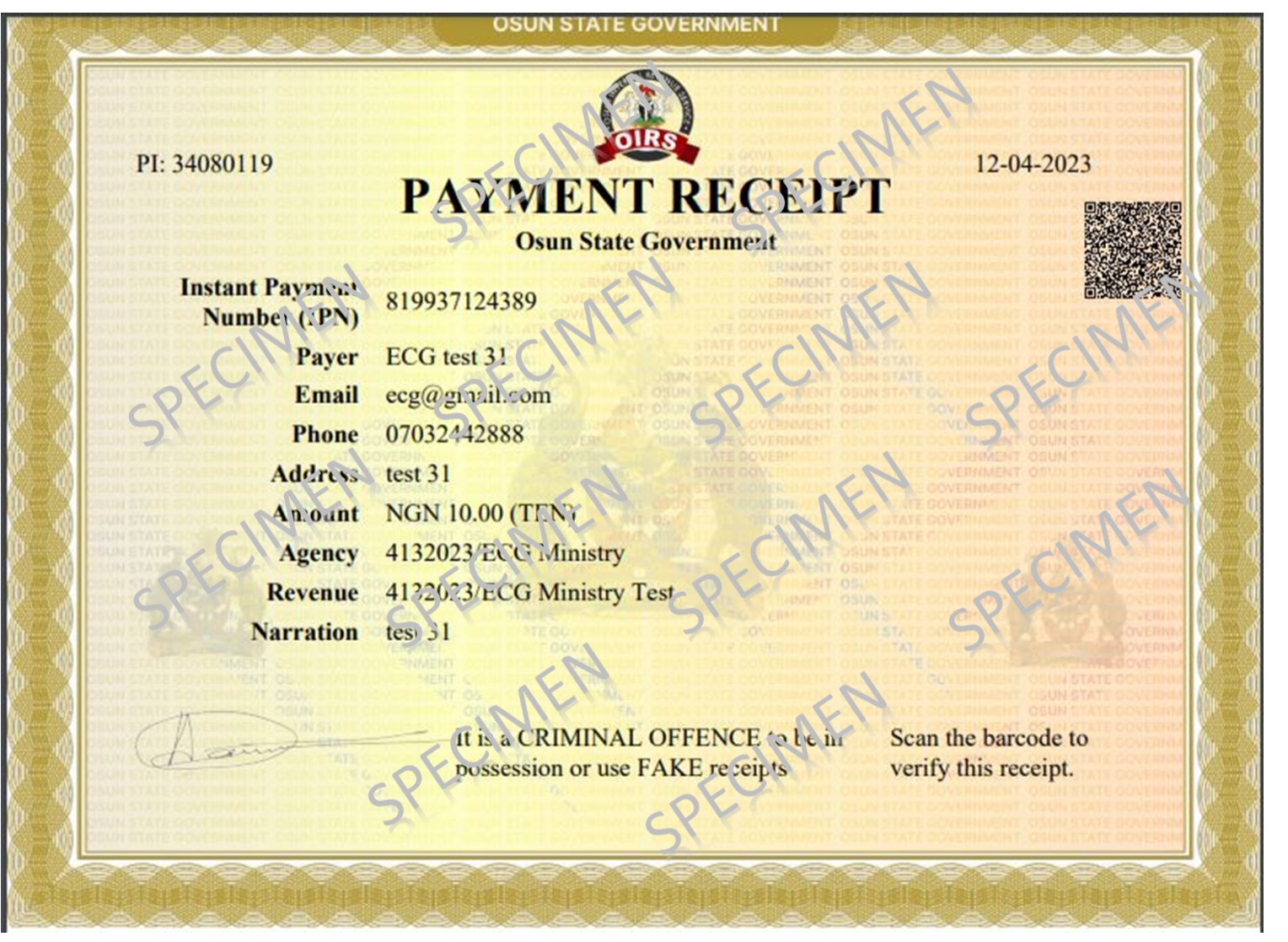

Generate automated revenue receipt

Kindly contact the Tax Station closest to you. Should you face any difficulty, contact our Customer Service unit using any convenient channel below:

or call: +2348070943633