“Pay As You Earn” (PAYE) system in Osun State represents a type of tax that employers deduct from their employees’ salaries and wages. Commonly known as “Personal Income Tax”, this deduction is in accordance with Section 81 of the Personal Income Tax Act (PITA), which is applicable to all individual income.

To remit PAYE, employers initiate tax deductions from employee salaries and pay the deducted amounts to the Osun Internal Revenue Service (ORIS), the regulatory body for taxation in Osun State. This can be done through designated collecting banks, online channels, and POS merchants. Subsequently, employers present proof of payment to their local tax office.

It is crucial for employers to ensure timely remittance of PAYE to Osun Internal Revenue Service (OIRS), with payments due on or before the 10th of the month following the deduction month. For instance, January PAYE should be remitted by February 10th. It’s important to note that PAYE deductions are applicable to contract employees and interns. At year-end, employers are required to submit updated returns on all salaries and wages paid to employees in the preceding tax year. This filing must be completed at the employer’s tax office before January 31st of the following year. For example, returns for the year 2019 must be filed by January 31, 2020.

The PAYE rates in Osun State operate on a graduated-scale system. The tax rates increase based on the employee’s annual taxable income. The applicable scale is as follows:

a. The first N300,000 is charged at 7%;

b. The next N300,000 is charged at 11%;

c. The next N500,000 is charged at 15%;

d. The next N500,000 is charged at 19%;

e. The next N1,600,000 is charged at 21%; and

f. Any amount above N3,200,000 is charged at 24%.

If an employee’s annual taxable income falls below the N300,000 threshold, the applicable tax rate is 1%. For instance, if an employee earns N5 million annually, the first N300,000 would be taxed at 7%, the next N300,000 at 11%, the next N500,000 at 15%, and so on, until the maximum threshold is reached, ensuring a progressive taxation approach.

Below are the steps to follow in making your ”Paye Payment”

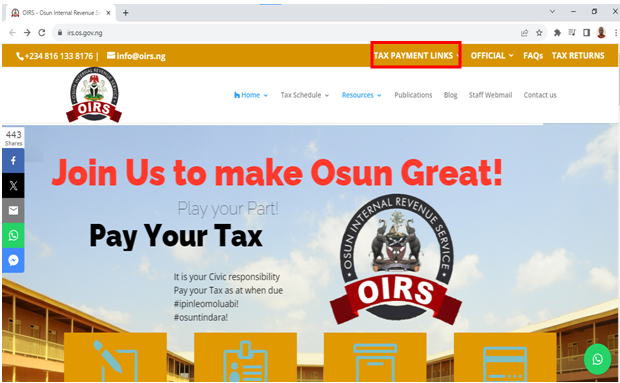

- Visit the website: https://irs.os.gov.ng and click on “Tax Payment Links”

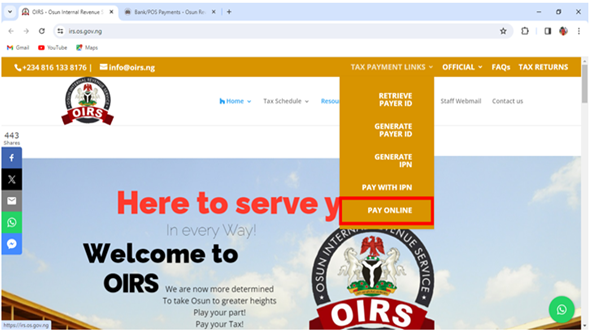

- It will show a dropdown, click on “Pay Online”

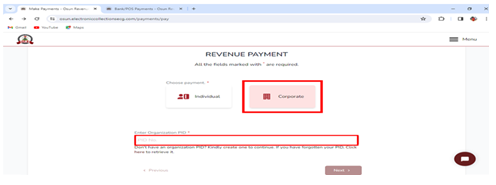

- It pops up to a page where you choose the ‘payment type’ and input your Payer Identification Number (PID). You can click on “Don’t have a PID? to create one if you don’t have one

- Select corporate for your Paye payment

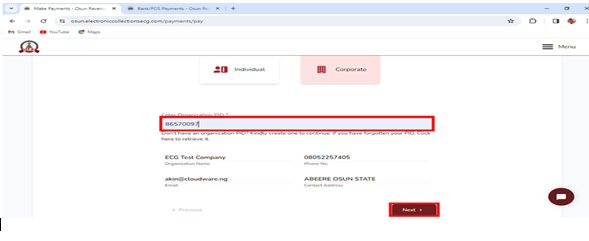

- Then input your unique corporate payer identification and the system will retrieves the details of the taxpayer as shown below

- And proceed by clicking the NEXT button

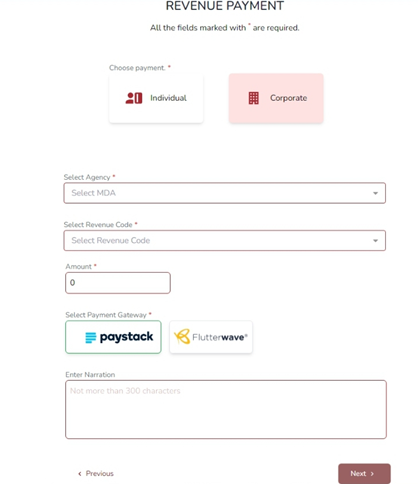

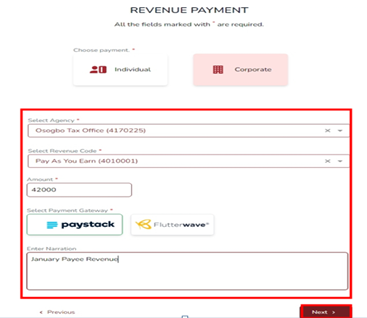

- Provide the information required on the revenue payment as shown below

- Select Agency, Select Revenue Code, Amount to Pay, Select Payment Gateway and Enter Payment Narration then click the NEXT button

- Preview the shown information; if correct, click on PROCEED button

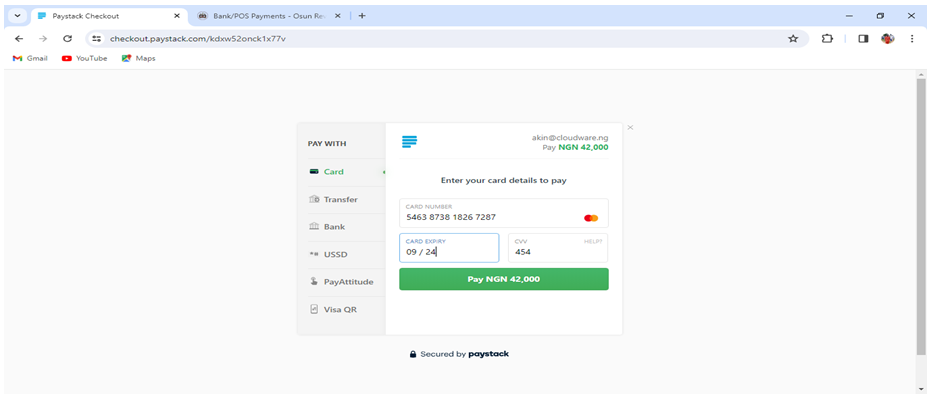

- Make payment on any of the multiple channel available (Card, Transfer, USSD, Pay Attitude, Visa QR)

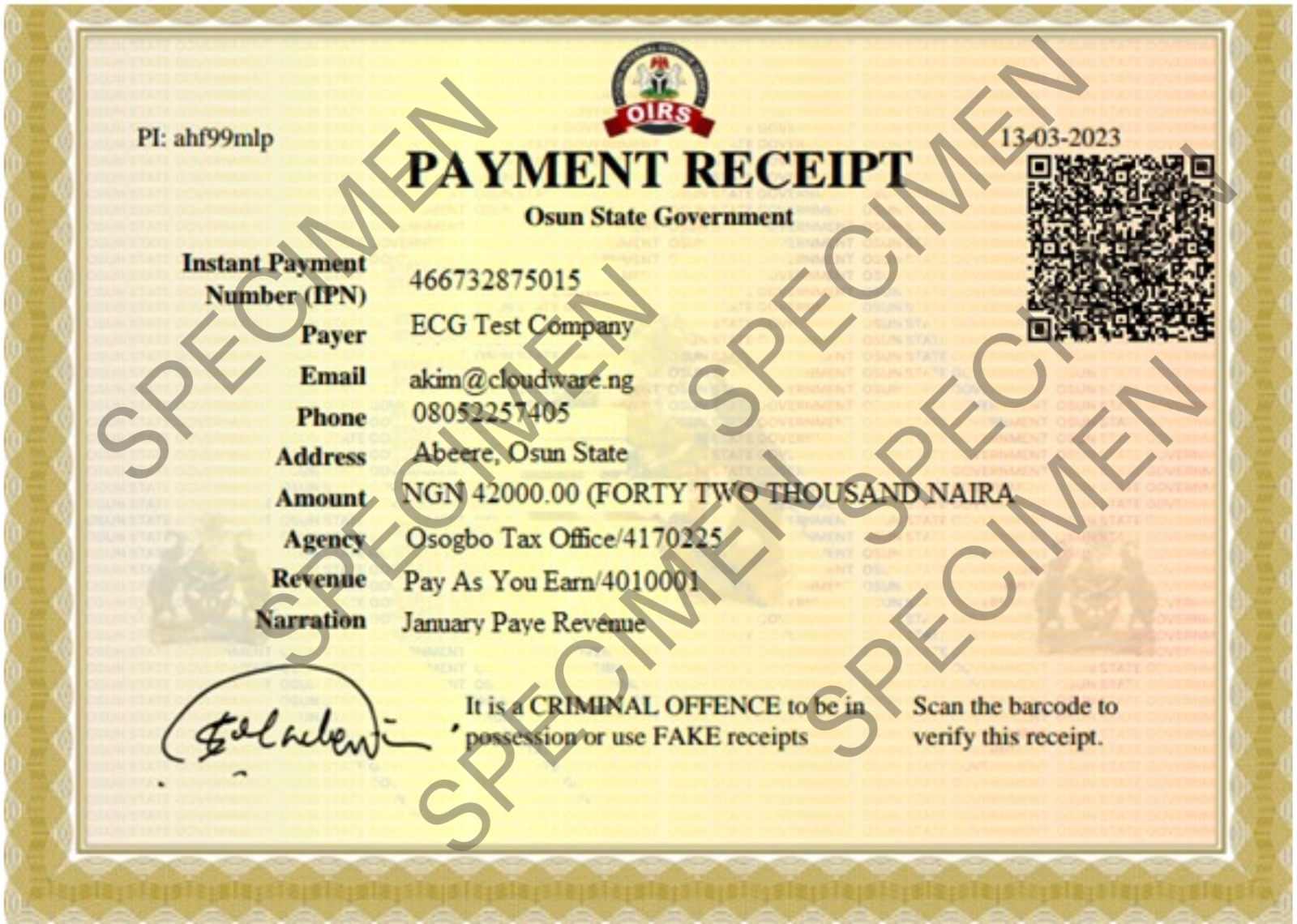

- Generate automated revenue receipt and document for future reference

We trust that you’ve found the solution on easy steps to Pay Your Pay As You Earn (PAYE) payment in Osun State. Should you require additional assistance, feel free to reach out to us through the following channels:

Phone: Call 08070943633 for immediate assistance.

Email: Send complaints to info@oirs.ng for a swift resolution.